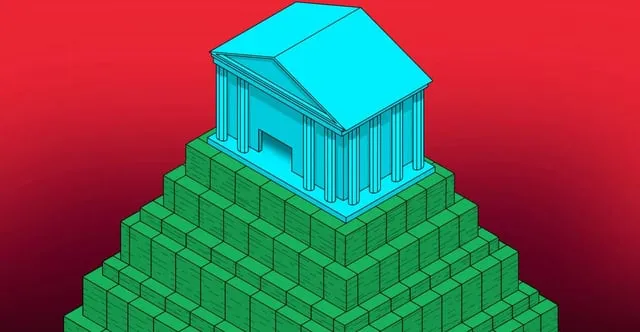

I've been hearing the term "AI bubble" a lot lately, and I was wondering just how serious it really is💭

Well, according to one analyst, this AI bubble is apparently 17 times larger than the dot-com bubble of the early 2000s😳✨

Just hearing that makes it hard to imagine... 17 times? What does that even mean!?

What exactly is a bubble? A quick refresher💡

A bubble is when too much money flows into something due to expectations and hype, exceeding its actual value, and then later it collapses with people saying "Well, it wasn't worth that much after all."

Famous past examples include the dot-com bubble (when internet-related stocks skyrocketed and then crashed) and the subprime mortgage crisis that triggered the Lehman Shock.

How big is the AI bubble?

According to the analyst's calculations:

- 17 times larger than the dot-com bubble

- 4 times larger than the subprime bubble

That's what they're saying🥺💥

It's hard to visualize, but this means "there's an enormous amount of expectation building around current AI-related companies and technologies."

The money being invested in AI is growing at an incredible pace, easily surpassing past bubbles.

Why is there so much excitement?🤔

Probably because since generative AI like ChatGPT appeared, people have started thinking "AI can do this and that too!"

New technology is exciting, and everyone wants to invest in the future🌸

However, since big bubbles like this eventually calm down, it might be wise to keep in mind that "prices might be jumping up based on expectations alone"💬

To summarize🎀

- The AI bubble is historically quite large in scale

- Being 17 times larger than the dot-com bubble and 4 times larger than subprime are truly staggering numbers

- That's why it's important not to blindly believe investment or news information and to look at things calmly💭

Honestly, just hearing the numbers makes me nervous, but I still can't help but get excited about new things😆✨

But I think it's important to understand the risks too🧠

Taking a slightly more冷静 look at the AI excitement like this might be interesting! I hope you find it helpful too💗

Comments

グレース

The economy is like a three-legged stool, but right now all the legs seem to be made of AI fantasies.

ジャック

If this pops, I'm genuinely scared about what will happen to regular people like us.

リリー

In terms of scale, the current economy is about 4 times larger than the 2000s IT bubble and 2 times larger than subprime (roughly speaking).

ハンナ

I really hope they don't do any bailouts.

クリス

Are they taking into account the trillions of dollars circulating in 'investments' too?

ベン

2+2? 5? That doesn't make sense, but interesting question.

ハンナ

Economists haven't been right in their predictions for the last few times, have they?

ノーラン

Another capitalist loophole hunt that leaves us relying on food banks... This economic system crashing every 10-15 years is really problematic.

ジョージ

I don't want to trust analysis companies that target media anymore. They also predicted iPhones would cost $2000, but everyone forgot about that.

リリー

This company's founder said deflation would come in 2023 and recommended shorting NVDA in 2024. The lesson is not to believe everything.

ロバート

I'm 41 and I don't want to experience every single bubble!

クロエ

4 times larger than subprime? No, that's an exaggeration.

クリス

Even if the bubble pops, investors in OpenAI and Anthropic will take losses, but it won't drag down all banks like the 2008 banking crisis. AI is math and computer science, so it won't collapse easily from interest rate hikes.

レオ

Some companies are overvalued in the AI bubble, but actually useful services like ChatGPT will continue to grow, so I think it's different from the 2008 financial bubble.

ハンナ

Our Reddit, YouTube, and social media posts are being used without permission and we're not getting a single cent. Calling for bailouts later would be outright theft.

ワット

The problem isn't AI itself, but the skewed way money is flowing in. We lack the physical infrastructure to run it more than we lack GPUs or models.